Introduction

The application allows you to define individual VAT rates for your invoice. The individual tax rates are created per invoice.

Below we show you an example of how an individual tax rate of 2.5% is created and applied.

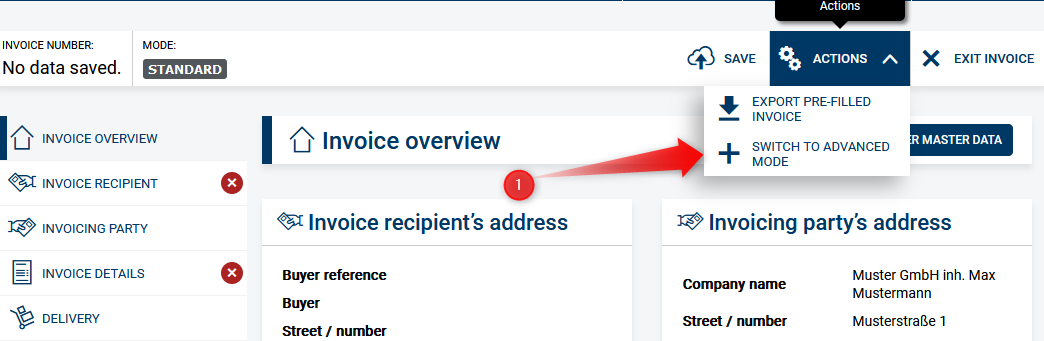

1. Switch to advanced mode

Use the "Actions" navigation element to switch to "Advanced" mode (1).

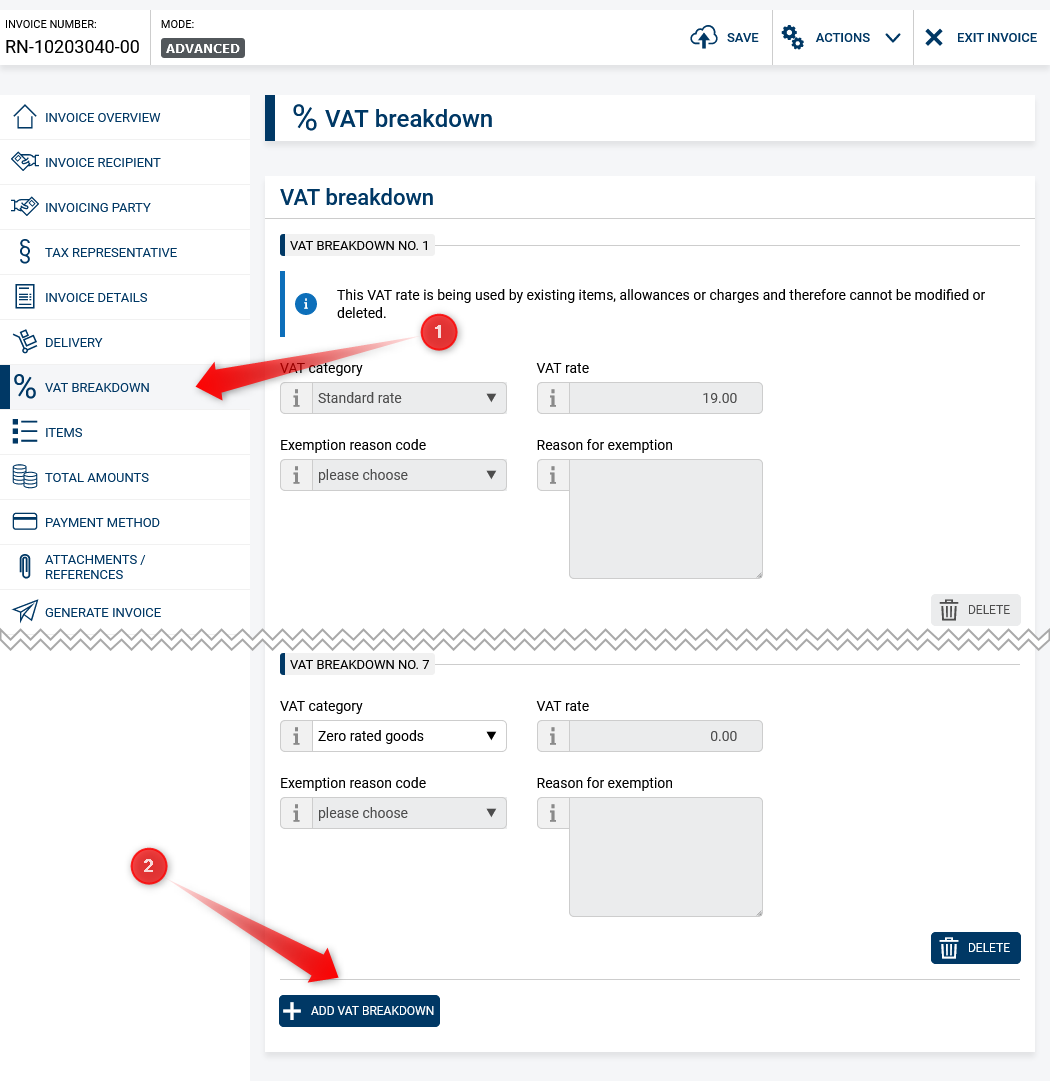

2. Open VAT Breakdown Module

The left navigation bar will now additionally display the VAT Breakdown module, please click on it (1) and scroll down to the "Add VAT Breakdown" button (2) at the bottom of the page.

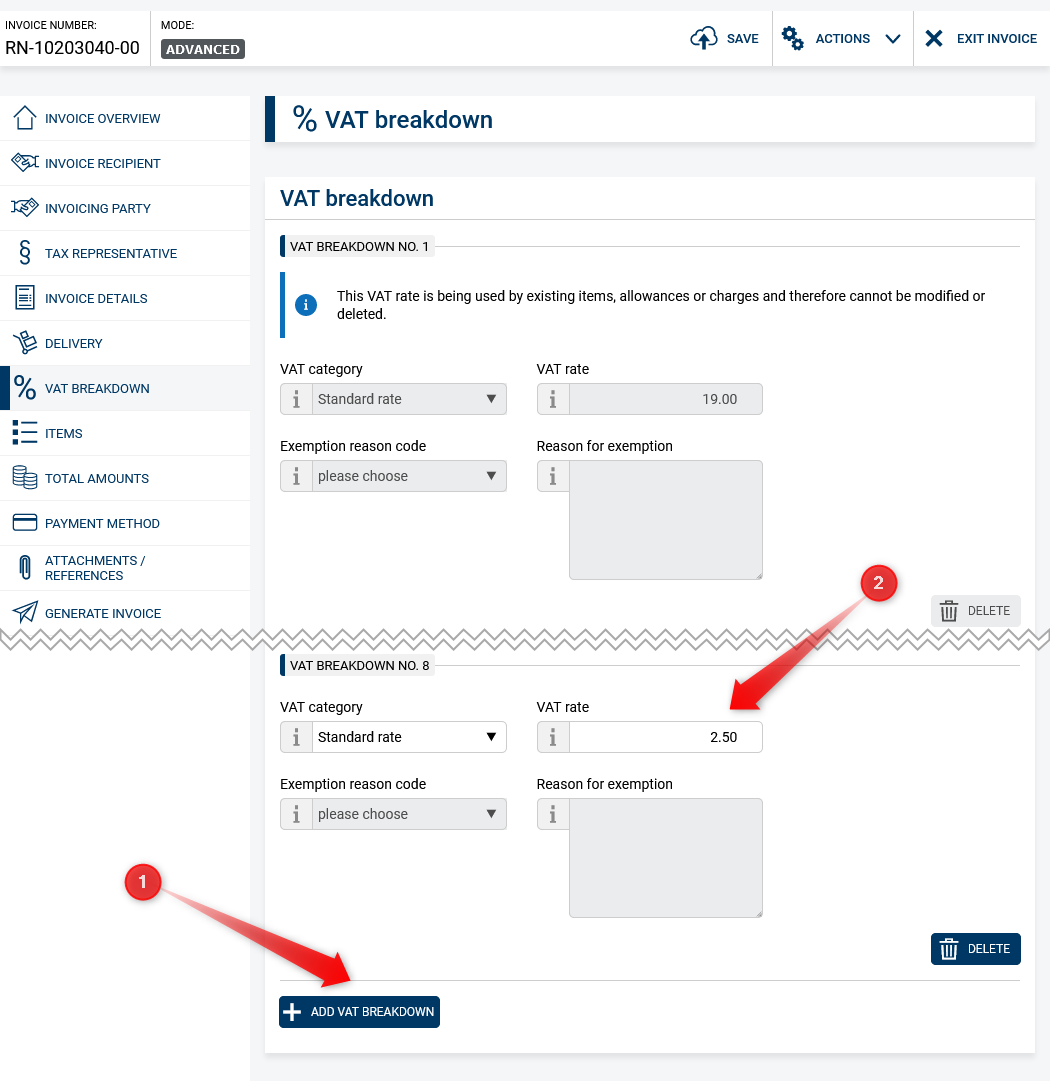

3. Add new VAT rate

Now click on the "Add VAT breakdown" button (1) and enter the value 2.5 as the "VAT rate" (2).

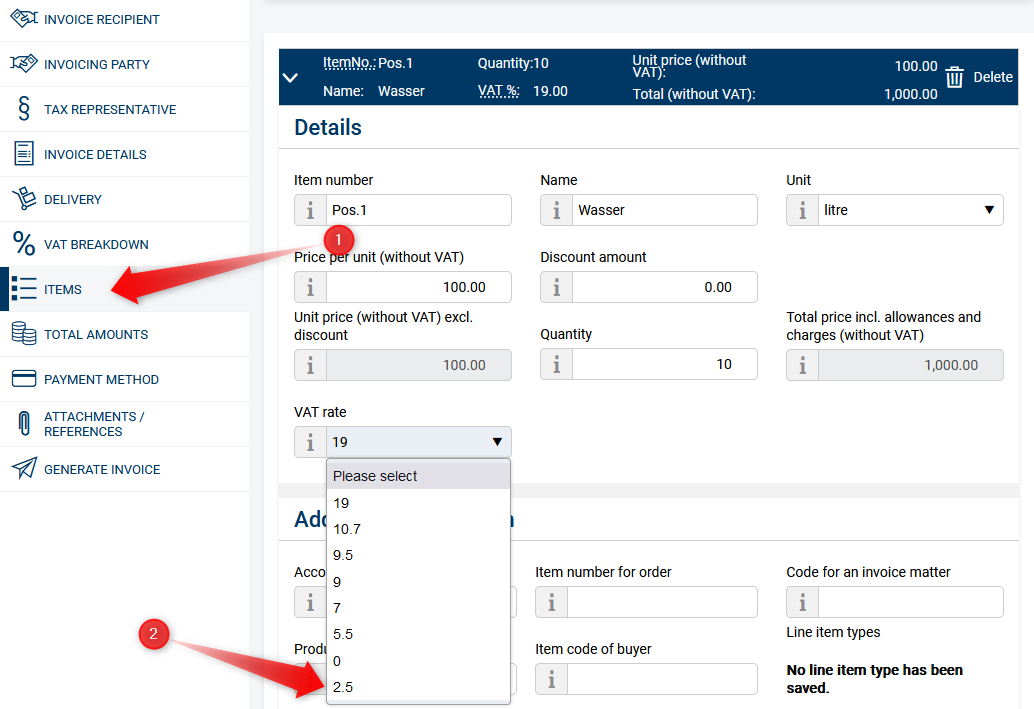

4. Use sales tax rate

You can now use the added VAT rate. In the items module (1), the new VAT rate of 2.5% can be selected for a line item (2).